Driving into the Future: Exploring In-Car Payments – More Than Just Transactions

by AutoExpert | 12 January, 2024

In the ever-evolving world of car tech, we've encountered a new player on the field – in-car payments. Not quite the same as your in-game purchases, but it's all about spending while on the go. Let's dive into the world of in-car payment systems (ICPS) and figure out what they mean for your daily drives.

Are We Talking About Payments Made from the Infotainment System Screen?

Got it in one. Car makers are hoping to make life easier for drivers in all sorts of ways. But it’s not all benevolence and philanthropy. In-vehicle commerce is predicted to generate a tonne of money – circa USD300 million – by the end of the decade. Car makers understandably want a piece of that action.

Money Talks. In What Kinds of Ways Will Life Get Easier With ICPS?

In November 2023, Skoda told the world that it had integrated a way to pay for fuel via the centre display screen. Available in six countries, the service doesn’t eliminate the need for humans altogether… until the robotic fuel pump assistants arrive, that is.

Instead, drivers can select a fuel station cooperating with the service using an app on the interface. Choosing the pump number, refuelling and then confirming the amount of juice you’ve loaded into the tank, the app then asks for card details. Simples.

Hmm, Sounds a Bit Tedious. Wouldn’t Such a Feature Create a Queue, Rather Than Skip One?

Good point. We don't know one millennial that hasn't sat patiently, albeit painfully, watching a technologically challenged boomer trying to type a text message. While not all drivers are super tech-savvy and not all interfaces are pleasant to input information into, in fairness this kind of feature probably isn't aimed at them.

Is It Safe?

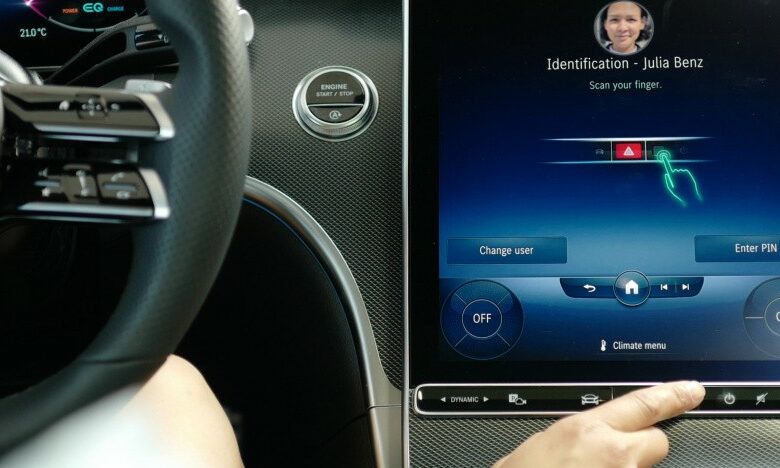

Great question. Since 2021, Mercedes Benz has had a partnership with Visa to pay for fuel, parking, and other services via the simply named Cloud Token Framework and Digital Authentication system in its MBUX suite. That mouthful uses biometric ‘fingerprint’ tech as part of a two-factor authentication (2FA) programme to verify identities and ensure any saved payment card data is as secure to use inside the car’s system as it is to use on your mobile phone.

Ok, But If I Have My Phone and My Smart Watch, Is Any or All of This Really Necessary?

The people at Daimler seem to think so. In September 2023, the brand announced another partnership – this time with Mastercard – to enable native in-car payments with fingerprint authentication. According to Mastercard data, around 50 per cent of 18-to-39-year-olds in Germany would use their cars to pay for goods and services directly. And that jumps to 60 per cent when talking about fuel and EV charging.

Which Other Car Brands Are Doing This?

Hyundai introduced an ICPS for parking back in September via a partnership with Parkopedia. In a similar vein, you rock up, select the parking space and duration and put the transaction through via your touchscreen.

Outside of automotive, you won't be surprised to hear Visa, Mastercard, and Paypal are all very enthusiastic about the development of ICPS. If you're beginning to feel like the product again, rest assured, you are. All of this spending via the car enables companies to track your spending habits. Data is the new oil, remember.

Oh, Goody. Anything Else I Should Know?

Yeah, back in February 2022, General Motors shelved a project called ‘Marketplace’ which enabled drivers to buy fuel, coffee, parking and make restaurant reservations. Integrations with Shell, Starbucks, and Dunkin' Donuts featured on the interface, but the car maker said learnings about customer needs and preferences justified the decision to shut Marketplace down.

Let’s Talk About the Cons.

Well, for starters, all this computer science voodoo wizardry relies on a good old-fashioned data connection. Then there's customer demand. Frankly, if you’re already out of the car to refuel, where’s the real saving from just paying using the pay-at-pump machine? Or even using the cashier? Less temptation from the till-placed chocolate and doughnut promos? Perhaps.

And what about those long-standing rules about not using your mobile phone in fuel stations. How is this any different? Have we been lied to the whole time?

Hmm, Why Should I Care About ICPS?

Before the existential crisis sets in, consider that some car insurers are looking to utilize the center display to enable drivers to begin claims immediately. Such a feature would mean that within hours, possibly minutes, of a collision with another vehicle, you could already have a pay-out.

Hold Up. Are You Saying We Can Claim for Collision Damage Through Our Display Screens?

Very nearly probably. At least, that’s where the industry is aiming to get to, according to some analysts. One of the reasons premiums are so high – so they claim – is the amount of time it takes to process the claims. If the info could be supplied in near-enough real-time, this could streamline the whole process. And by default, save us all many pennies.

When’s This All Expected to Happen?

We appreciate the faith you hold in our crystal-ball-gazing. Obviously ICPS already exist in some cars and provided there's customer demand, the market opportunities are too big for some not to put a wager on.

When all is said and done, your guess is as good as ours, but GM's Marketplace failure highlights the importance of timing. The next generation of drivers, already au fait with tech and in-gaming purchases, may be the ones to take ICPS to new places.